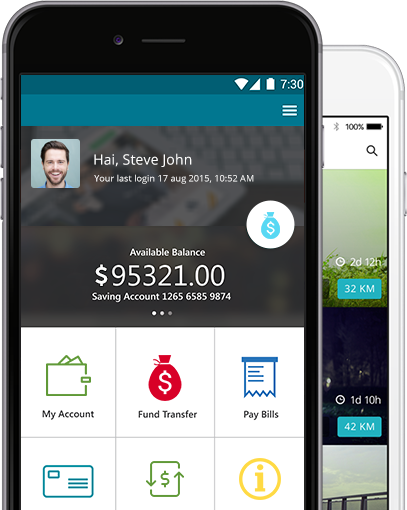

1675474customers using our apps

Your Innovation Engine

For building a customer facing mobile solution for needs great level of understanding enterprise level systems and new technologies in the mobile world. DBL is the perfect combination for this and we have proved this with our engagement with largest financial institutions in the world

When it comes to mobile, user experience and performance matters. We bring in you the best team who can create world class customer experiences along with top noche mobile technology expertise. Our middleware systems are know for scalability , robustness and security

We have no legacy burden & don’t mind going the unconventional ways to solve problems. Working in tight schedules & creative problem solving are stuffs that we do everyday & love to do every time

We proved to be our clients trusted partner because we are built for agility, quality & innovation. We keep a flat organizational structure promoting innovation inside our team that can be leverage by our strategic partners.